Transportation Funding

Key Concepts in Transportation Funding

- Capital Expenditure – Expenditure on new infrastructure & equipment

- Operation & Maintenance Expenditure – Recurring payments to cover the cost of administration, operation, and normal maintenance and repair

- Discretionary Grants – Grants from government that are discretionary based on benefits

- Transportation Improvement Program (TIP) – A capital program listing the committed investments for 4 or 5 years

- Impact Fees – Fees charged to developers related to the infrastructure improvements

- Public/Private Partnerships – Formal or informal relationships among government agencies and private entities

- Risk Analysis – A systematic process to understand the nature of and deduce the level of risk

- Trust Funds – An account established by law in a treasury department to hold tax receipts

- Year of Expenditure Revenues – Dollar values that have been escalated to the year that dollars are expended or generated

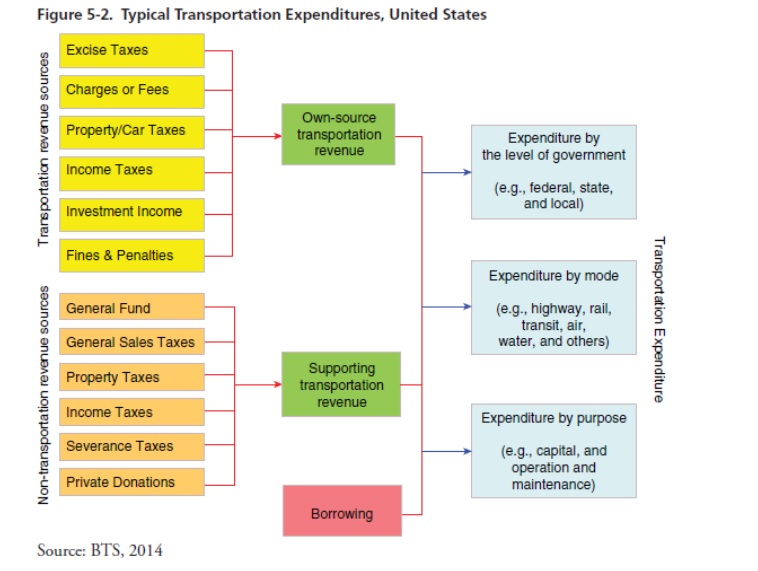

Tranportation Fund Sources & Expenditures

Motor Fuel Taxes

- In the United States, motor fuel taxes are the primary source of funds for transportation investment.

- Interstate system was constructed majorly funded with these and they are in place since mid-1950s

Highway Trust Fund

- The gas tax receipts were to be deposited in the U.S. Treasury in a special account

- These are dedicated to construction of mostly highways not other modes

- For example, the Michigan Transportation Fund (MTF) is contributed by gas tax and vehicle registration fee

- These funds are distributed to the Michigan DOT (39.1 percent), counties (39.1 percent), and cities and villages (21.8 percent)

- Federal and state gas tax revenues are spent to achieve specific program goals, such as safety, economic development, congestion relief, air quality improvement etc.

VMT Mileage Based Fee

- If the consumption of motor fuel will decline, then motor fuel tax revenues also diminish

- Charging vehicles for the use of the highway network, most often defined as a VMT fee

- Use GPS or some other means to identify how vehicles traveled

- Pilot studies are conducted in Oregon and other countries like UK especially trucks. Caveat: People may complain about the privacy issues

Tolls

- High Occupancy Tolls (HOT)

- Single occupant vehicles can use the managed lane during peak periods for a price that often varies by the level of congestion in the lane.

- Prices can be variable

- Debatable concept as higher income people afford and transportation equity

- Express Tolls

- Similar to HOT lane concept , whereas this lane can be used by all automobiles

- No revenue loss due to violations

- Truck Only Tolls (TOT)

- Similar to HOT lane concept, but are dedicated to commercial vehicles.

- Most proposals have the lanes next to regular freeway lanes, but separated with some form of barrier.

- E.g. Port of Long Beach, Port of LA

Cordon Pricing & Parking Charges

- Cordon pricing

- The basic concept is that vehicles are charged a fee to enter a highly congested area.

- London and Singapore has successful cordon pricing models

- Requires technical infrastructure

- Eg. New York City was considering a congestion charging scheme as part of a federal demonstration program, but political considerations stopped the initiative

- Parking Charges

- This helps to reduce congestion in central business district (CBD)

- It is easy to implement and can change driving behavior

- Different cities use this strategy to reduce congestion E.g. San Francisco adds 25% extra fee for commercial vehicles, Boston freezes parking in certain neighborhoods in CBD, few California cities have “cash out “ program

Value Capture & Other Income

- Impact Fees—One-time charges collected by local governments from developers to finance new infrastructure and services associated with the new development.

- Special Assessment District—An additional fee assessed on properties near a new highway or transit facility that is expected to benefit from such proximity.

- Sales Tax District—Similar in concept to a special assessment district, the sales tax district requires those benefiting from a transportation investment to pay a limited sales tax instead of a property tax.

- Land Value Tax—A tax imposed on the value of land benefiting from transportation infrastructure.

- Transportation Utility Fees—Utility fees assessed on the basis of characteristics of travel demand, such as traffic volumes.

- Negotiated Exaction—A negotiated, one-time charge similar to impact fees, but not determined a priori by a formula or impact ratios.

- California is using a carbon-based tax to raise revenues for some transportation projects.

- Vehicle license/registration fees, weight fees/taxes, fines and forfeitures, property leases and air rights, advertising (for transit, mainly), and development agreements.

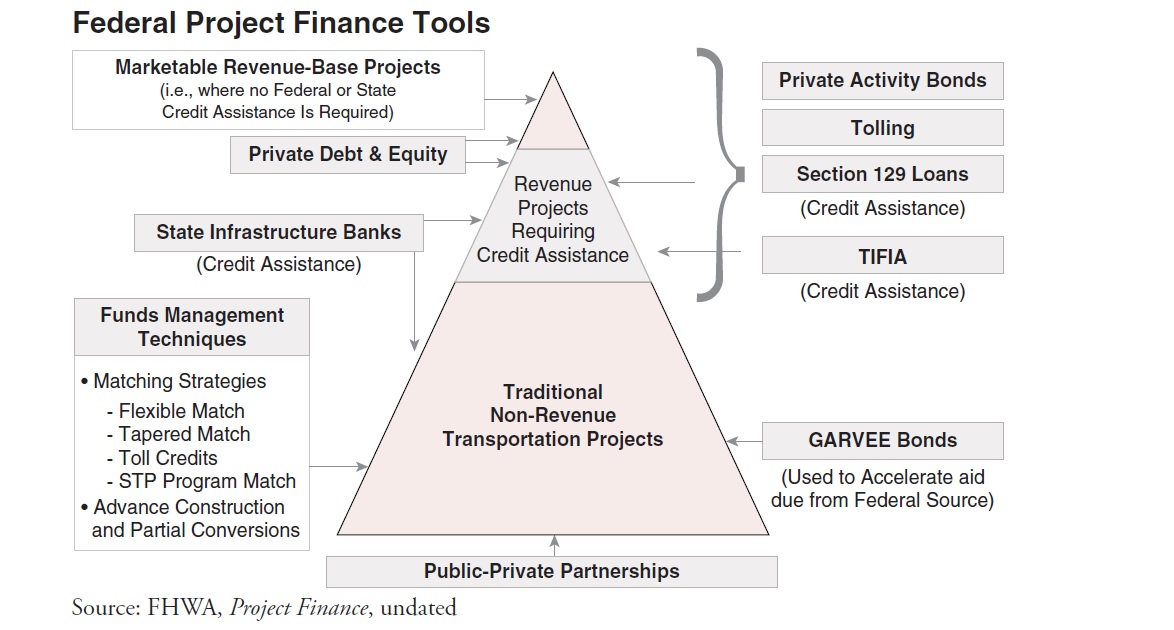

Transportation Finance Strategies

- Transportation Financing

- The mechanism by which funds are made available for transportation investment.

- It describe the combination of different funding sources that together represent the investment strategy for a region or state.

- Debt financing

- Very similar to a homeowner’s mortgage policy.

- The government borrows money from the municipal bond market at very low interest rates, and then has to pay back the principal with interest over a set number of years.

- The advantage the large investment gaps can filled up with the influx of capital funds

- The major disadvantage is, the principal and interest have to be paid back over many years.

- Following criteria has to be considered

- Debt per capita, Debt as a percent of taxable property, Ratio of debt service expenditures to total revenues.

- Ratio of debt service expenditures to all expenditures, Debt service coverage by pledged revenues.

- Another strategy being used by state DOTs is advance construction. This allows a state or local agency to initiate a project using nonfederal funds while preserving the eligibility for future federal aid.

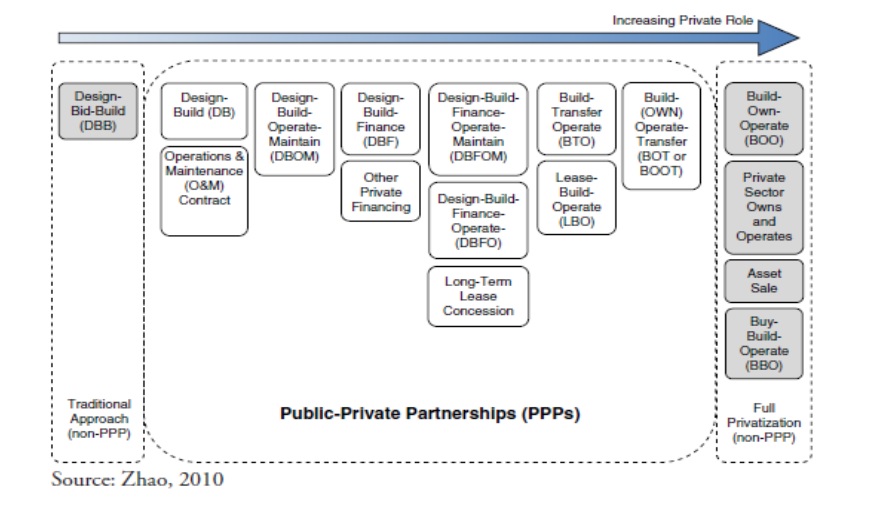

Public Private Partnerships

A public-private partnership is a contractual agreement formed between public and private sector partners that allows more private sector participation than traditional setup.

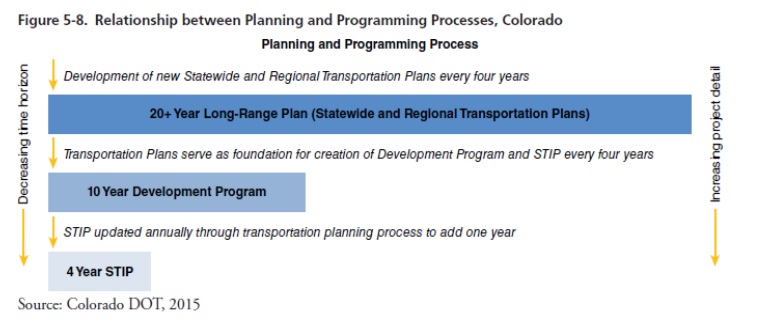

Investment Programming and Planning

- Transportation Improvement Program (STIP/TIP)

- Serve as a short-range implementation tool to address the goals of the regional long-range transportation plan.

- Provide continuity of current transportation improvement projects with those identified in previous TIPs.

- Identify transportation projects recommended for implementation by transportation mode, type of improvement, funding source(s), and geographic area.

- Estimate the costs of projects proposed for federal funding.

- Establish a prioritization of projects to effectively utilize federal funds as they become available.

Estimating Revenues and Costs

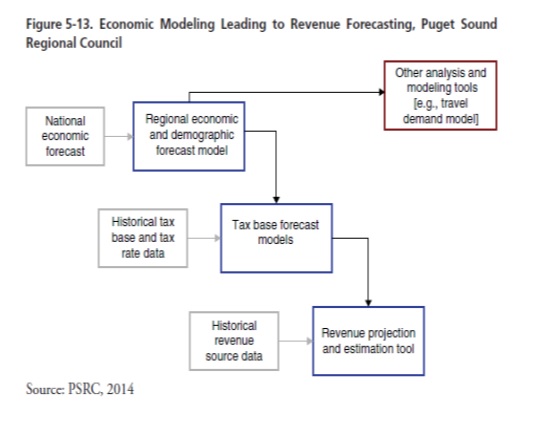

- Revenues

- Planners must know the underlying funding sources and the factors that influence the amount of revenue generated.

- Revenues depend upon demographics, vehicle registration, fuel consumption, vehicle sales and retail sales etc.

- Forecasting indirect revenues is also important i.e. penalties, tolls, traffic violations, interest on cash balances etc. Costs

- Capital project costs and O&M costs

- Project cost estimation responsibilities vary by agency role in project development

- Typically State DOTs are responsible for these costs, not MPOs

- Most estimates of future O&M costs are simply escalations of historic trends

Future Challenges

- The Future of Fuel Taxes – going to be lesser

- Bond Financing – Repayment eats up all the revenue

- Reliance on Non-Transportation-Related Tax Sources – Due to uncertainty in economy, may be lesser revenue in future

- Geographic Equity for Statewide and Regional Sources — More funds are spent on bigger cities

- Connected and Autonomous Vehicles – Lesser drivers and more infrastructure needs

- Cost Burden across User Groups — Trucks vs Cars, cost burden is not same